2025 Roth Ira Contribution Limits 2025 Married

Blog2025 Roth Ira Contribution Limits 2025 Married. And if you are married filing jointly, you can make a full roth ira contribution if your income is under $230,000 in 2025. Now, the limits are rising again in 2025.

Roth ira income and contribution limits for 2025; If you contribute too much or your income is too high, you.

Roth Contribution Limits 2025 Married Couple Clovis Adriana, Below is a guide to understanding roth ira contribution limits for 2025 and 2025, and why roth conversions may still be a smart choice for boomers and zoomers alike.

2025 Roth Ira Contribution Limits Married Inez Reggie, In 2025, married couples filing separately face stringent roth ira contribution limits.

Married Filing Jointly Roth Ira Limits 2025 Hildy Latisha, Married filing jointly (or qualifying widow(er)) less than $230,000 $7,000.

Roth Ira Limits 2025 Married Libby Othilia, Roth ira contribution limits in 2025 and 2025 by magi and tax filing status the following table shows how much you can contribute to your roth ira in 2025 and 2025 based.

Roth Ira Contribution Limits 2025 Magi Rica Venita, Review a table to determine if your modified adjusted gross income (agi) affects the amount of your deduction from your ira.

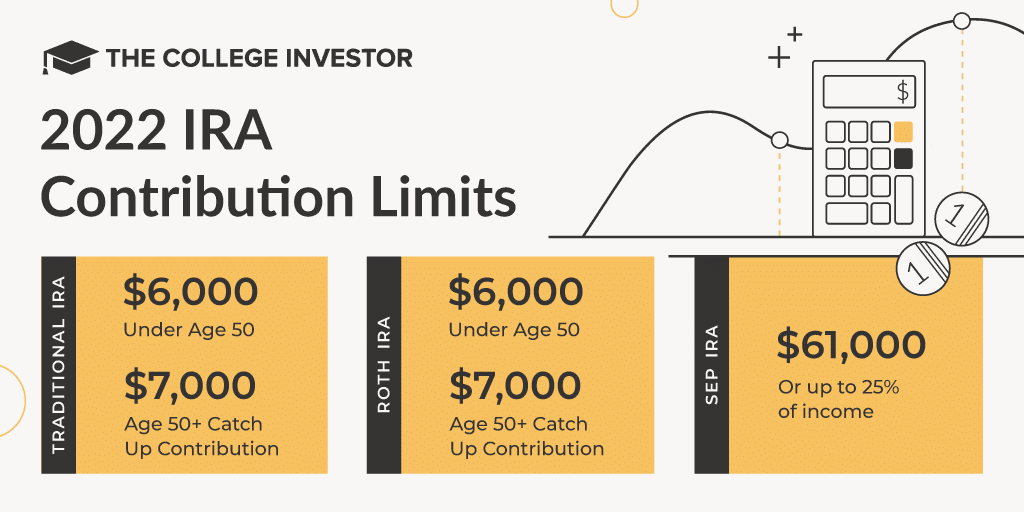

Maximum Roth Ira Contribution 2025 Married Cindra Carolin, For the 2025 tax season, standard roth ira contribution limits increased from last year, with a $7,000 limit for individuals.

Roth Ira Limits 2025 Limits Married Jointly Cindra Carolin, If you contribute too much or your income is too high, you.

2025 Roth Ira Contribution Limits 401k Limit Myrah Tiphany, Married filing jointly (or qualifying widow(er)) less than $230,000 $7,000.

2025 Roth Ira Limits 2025 Married Filing Sydel Katharina, 2025 ira contribution and deduction limits effect.